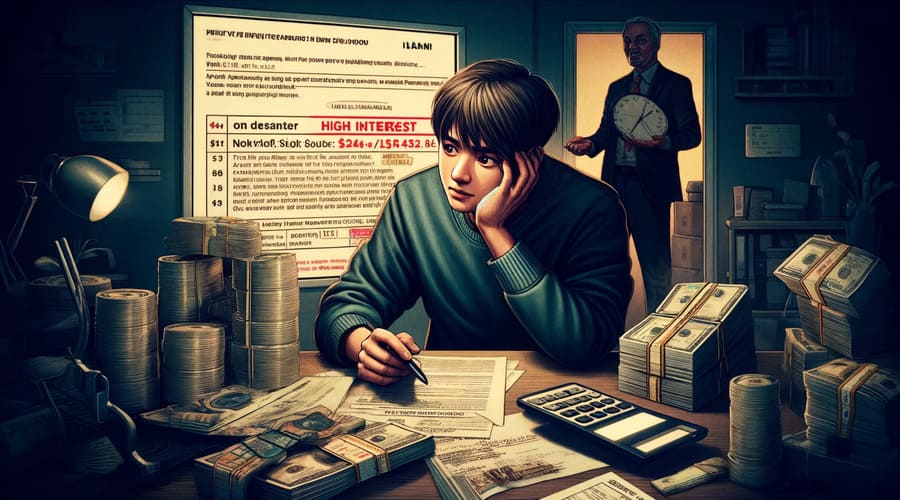

In the modern labor market, day laborers play a vital position in varied sectors, from construction to landscaping and home work. Despite their vital contributions, many of those workers face substantial financial challenges. Understanding the significance of loans for day laborers can make clear not solely their economic empowerment but in addition the broader implications for society as a whole. Financial institutions and neighborhood organizations are recognizing the necessity for tailored loan products that cater specifically to the distinctive circumstances of day laborers. This article will explore the necessity of loans for day laborers, the challenges they encounter, potential options, and the success tales that underline the constructive impacts of accessible financial resources.